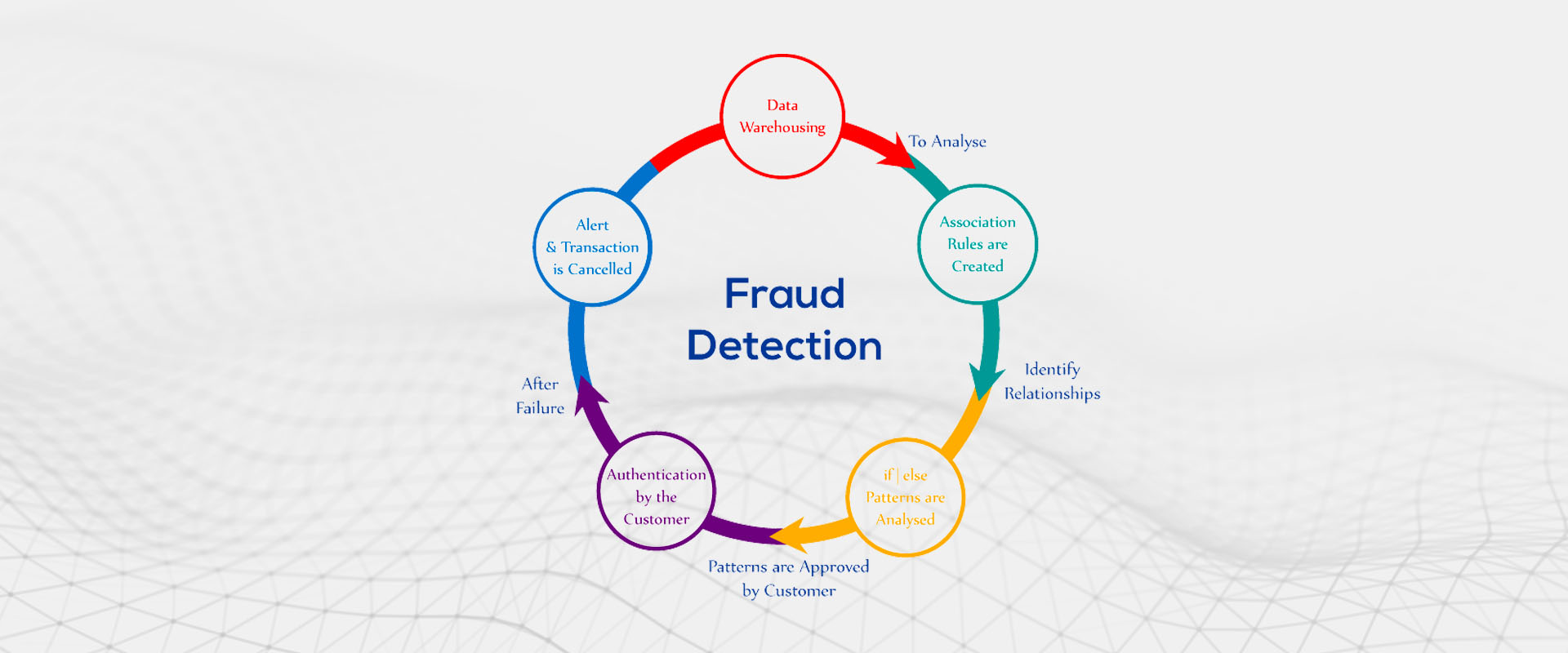

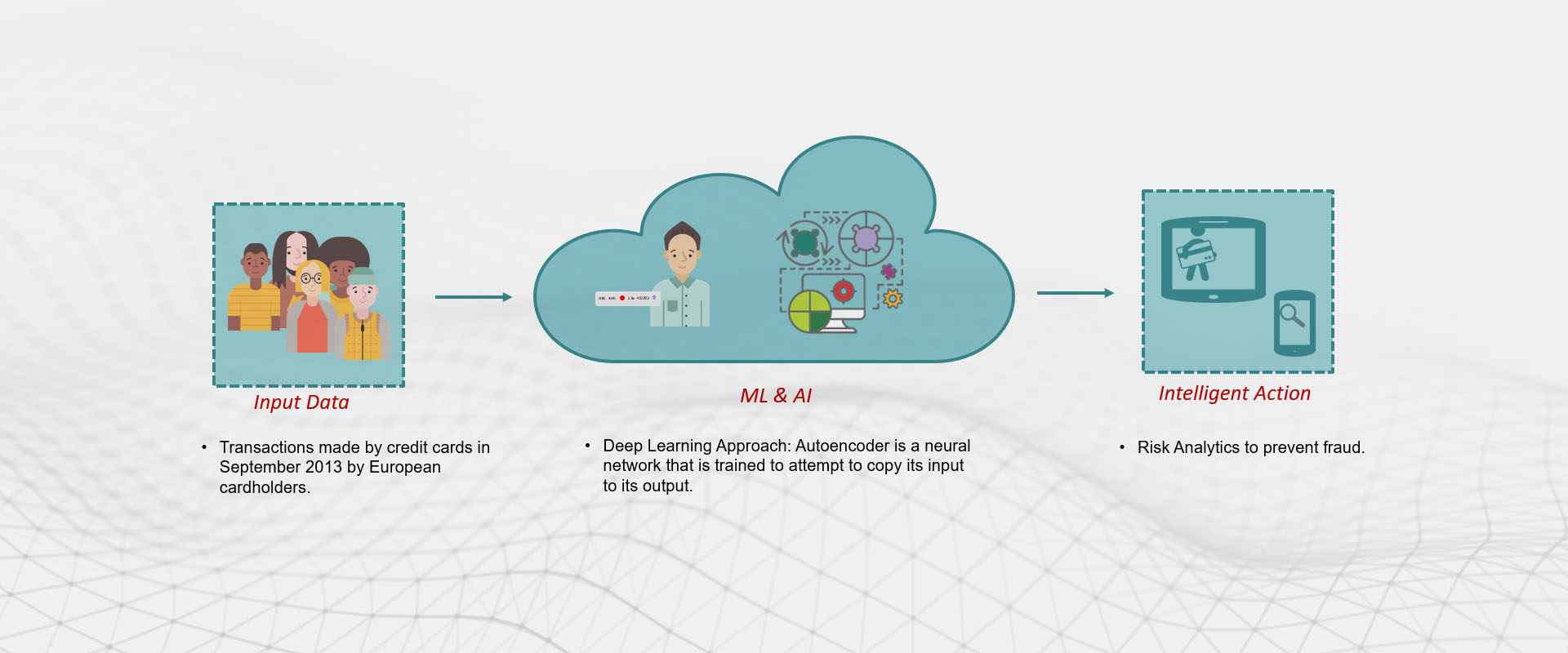

AI in fraud detection

It’s an agreeable fact that machine learning is basic for any organization that needs to remain ahead in the quick changing universe of fraud. Artificially intelligent systems make fraud identification increasingly precise, progressively versatile and a lot quicker. Organizations can stay aware of the huge measure of information streaming in, avert misfortune all the more viably and give a superior client experiences since fewer requests are declined or postponed.

Artificial Intelligence and Fraud Protection

It’s straightforward why machine learning has created such a buzz in the fraud detection community. Somehow or another, fraud prevention appears as though the perfect use case for this type of what some are calling Artificial Intelligence. There’s a tremendous measure of information connected to every exchange, there are solid patterns that can be found in purchasing behaviors and propensities (both those of good clients and those of fake ones), and there’s an answer toward the day’s end: an exchange will be charged back, or not. This implies you can label the information and give the machine input, which is the manner by which it figures out how to be progressively exact after some time.

Numerous organizations have incorporated artificially intelligent wholeheartedly, and have been interested by the surprising associations the machine had the capacity to make. Since the machine approaches the information impartially, and commonly is furnished to manage a lot of information, it can spot patterns and connections that people, whose see is increasingly constrained, are not ready to see.

Be that as it may, unsupervised machine learning will just take you up until now. We may discuss Artificial Intelligence, however up until now, despite the fact that machines can learn, they can’t think. They can just process and break down the data they’re given. That implies the outcomes you get are subject to the information you’ve given the machine. Put terrible, fragmented or deluding information in, and you’ll get awful, inadequate or deceiving information out. A machine won’t attempt to make sense of what’s going on with the information, or work out a path around that issue, or be visited by a snapshot of understanding that demonstrates the entire thing in another light.

Finding a solution to the problem: Artificial Intelligence

Artificial intelligence in fraud prevention has demonstrated a colossally profitable apparatus however not a silver projectile. While the speed and scale that machines are equipped for have changed what is conceivable in fraud detection, they aren’t sufficient without anyone else to understand the unpredictable difficulties included. A machine can be better at anticipating the climate, or at recognizing a photograph, than an individual. Be that as it may, neither the climate nor the photographs battle back. They’re not endeavoring to hide themselves, or trap the machine into supposing they’re something different, or growing new strategies.

Fraudsters, obviously, do every one of these things. Their entire methodology is to confound the information, to make their profiles look more persuading than they are, to embrace known attributes of good purchasers, to fly under the radar. They are ceaselessly thinking of better approaches to shroud themselves, and to empower full character shifts at a speed Clark Kent would envy. Also, they continually grow new extortion assaults, with new systems or new innovation. Here and there they’ll work in rings to befuddle the image further.

The majority of this is mistaking for a machine. At the point when things change rapidly, it very well may be hard for a machine to keep up. Machines exceed expectations at “huge information” – at finding the examples in really gigantic datasets. Be that as it may, misrepresentation, explicitly, is regularly about “little information”. You need to get the fraudsters before they’ve effectively stolen a huge number of dollars with another method that they had the ability to use again and again before your framework got on. Basically, you have to out-think them.

Adding human elements to machines: Helping in fraud detection

What numerous fraud groups and organizations do is use machine learning to a limited degree, and after that hand the issue over to manual commentators. The survey group will be in charge of going over exchanges which seem suspicious somehow or another.

Machine learning isn’t sufficient without anyone else’s input, however manual surveys bring back every one of the issues that machines were illuminating. They’re moderate, they’re not versatile, and they’re not unreasonably precise. Furthermore, a commentator whose activity it is to take a gander at one exchange after another and give a choice as quick as conceivable loses the incredible ‘10,000 foot see’ impression of the information that encourages the machine to discover examples and note patterns.

Fraud departments realize this is an issue, yet battle to stay up with the latest with creating patterns and to give time to look into far beyond that expected to choice individual exchanges. The Financial Impact of Fraud think about found that 56% of dealers state extortion moderation preparing time is hard to set aside. Indeed, even the individuals who oversee for the most part can’t organize it – and fraudsters move quick, so consistent advancement is fundamental.

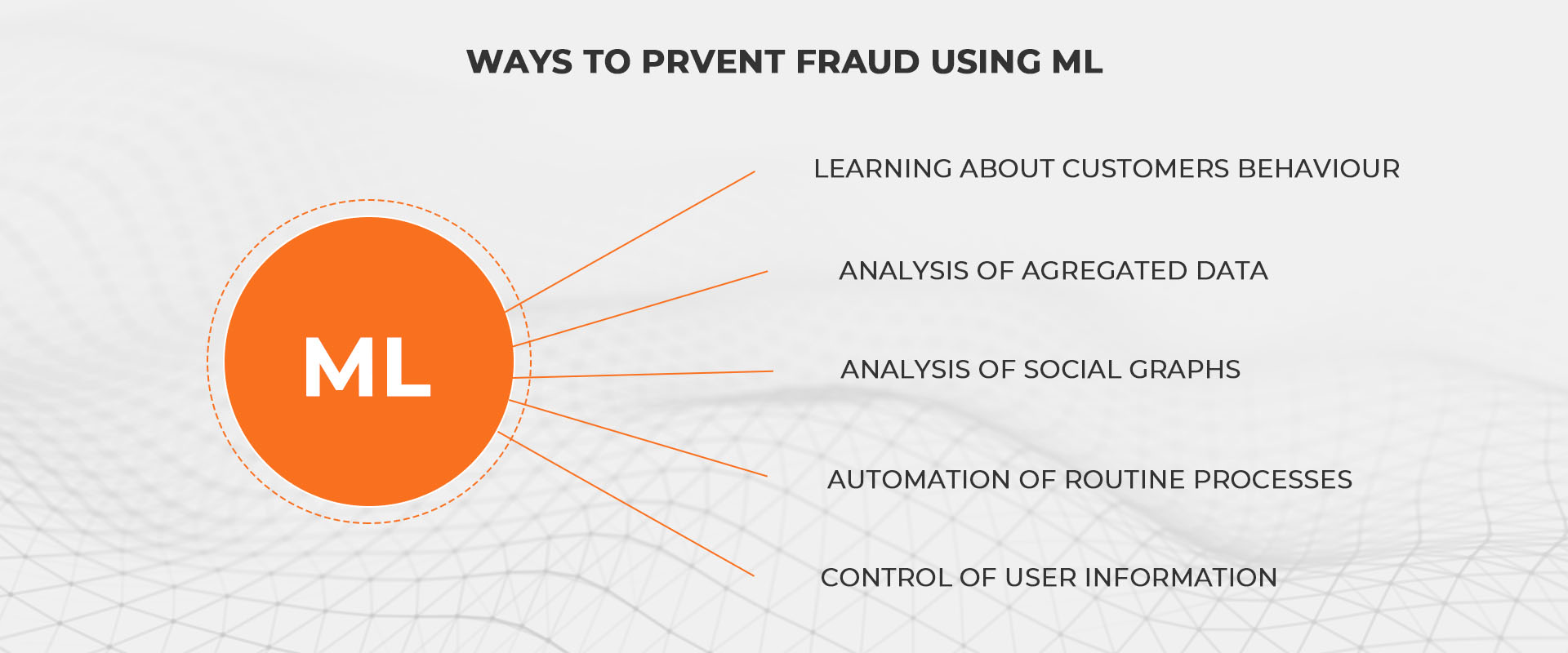

Behavioral and system examination –Artificially intelligent systems use huge information to recognize genuine client conduct from bot conduct by seeing irregularities inside site appearance designs. Partners of bots will in general visit a similar group of areas again and again in light of the fact that their conduct is computerized. Distinguishing these examples can enable us to surface bots dependent on their conduct. All things considered, most people don’t visit similar locales, in precisely the same request, on numerous occasions every day. On the off chance that these accomplices have just visited explicit areas that can show a pocket of bot movement, we track these examples and check this traffic as deceitful. Obviously, machine learning systems can likewise recognize designs in rush hour gridlock that aren’t quickly clear to human experts.

Program and gadget investigation – Machine learning enables us to recognize invalid traffic sources by coordinating program highlights to the client specialist. While this sort of assurance is frequently erroneously named deterministic, it would be outlandish without utilizing machine learning approachs to recognize designs inside extensive informational collections. Connected effectively, and controlled by adequate information, this strategy for identification can help to remove whole bot systems.

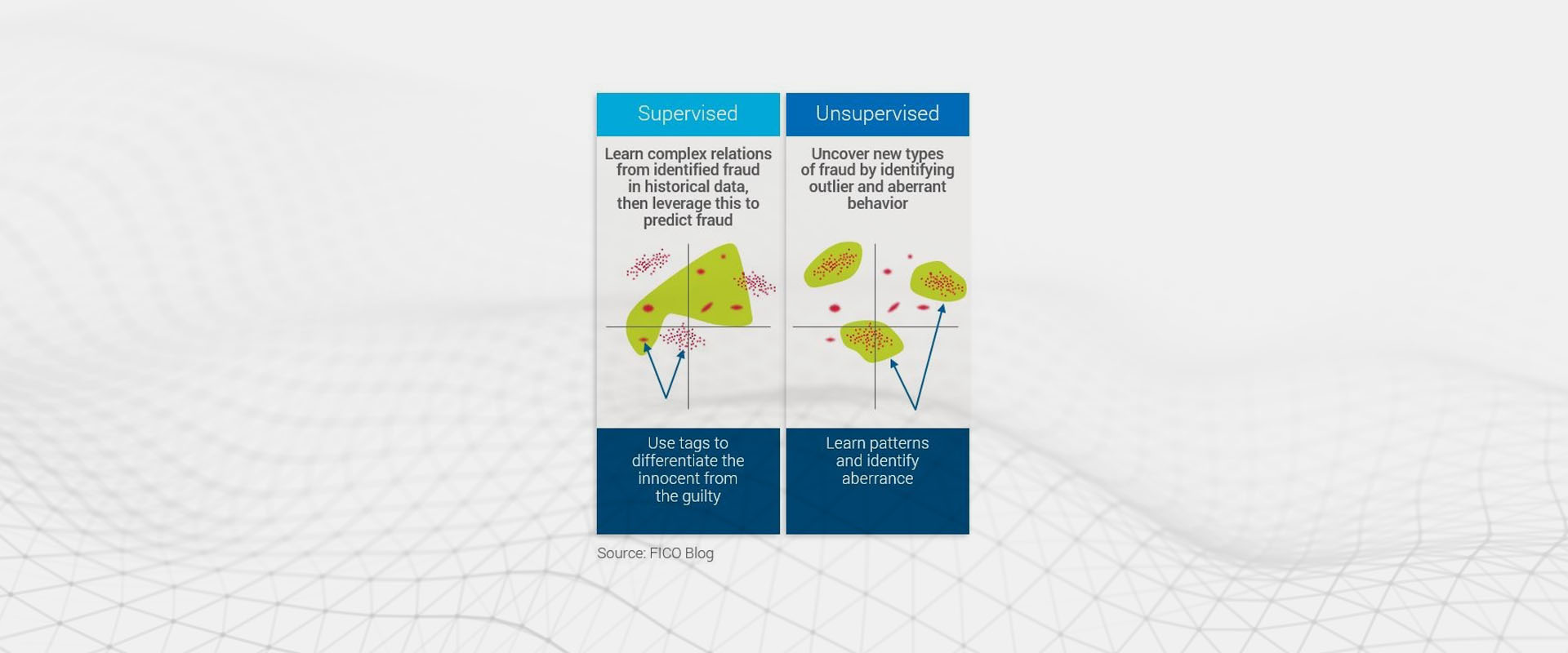

Strategy to detect fraud: Integrating Supervised and Unsupervised AI models

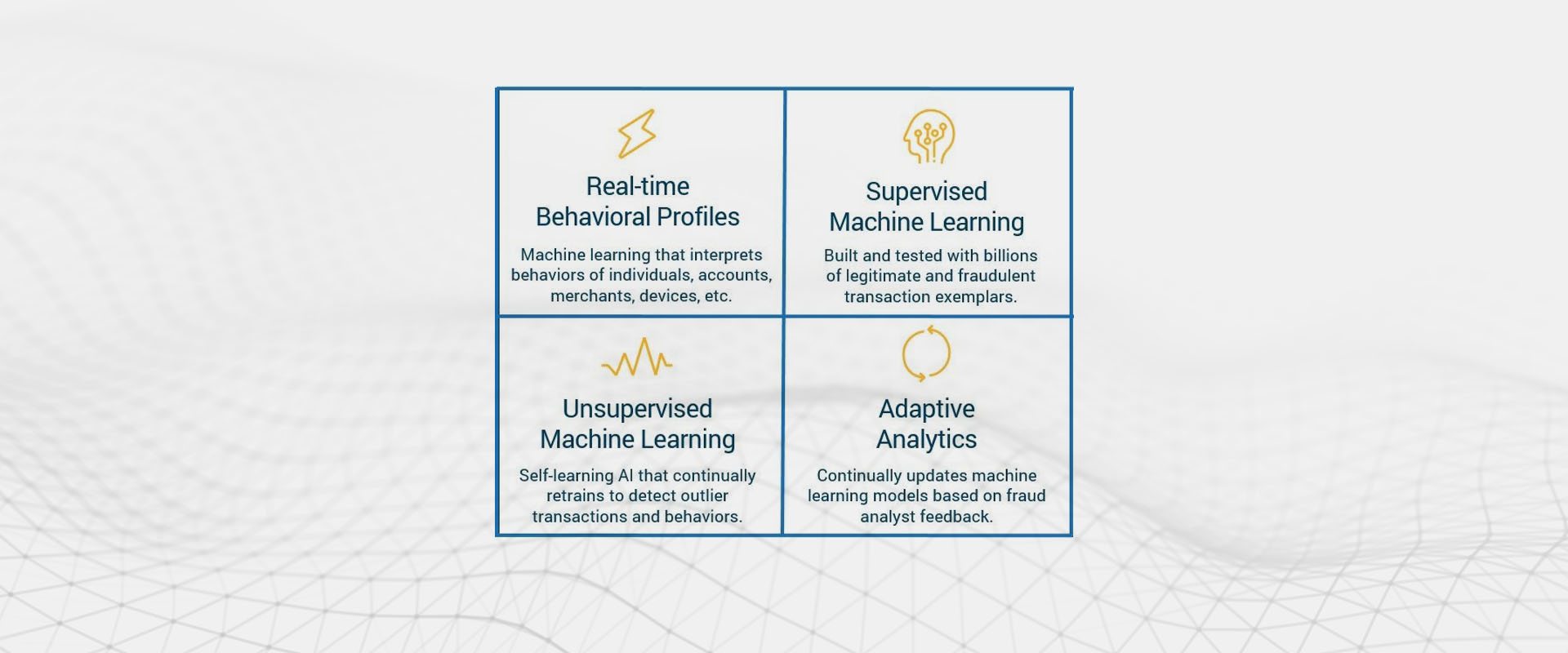

Since sorted out crime plans are so advanced and snappy to adjust, guard systems dependent on any single, one-estimate fits-all systematic procedure will create shoddy outcomes. Each use case ought to be upheld by expertly created inconsistency detection systems that are ideal for the current issue. Accordingly, both supervised and unsupervised models assume critical jobs in fraud detection and must be woven into exhaustive, cutting edge fraud systems.

- A supervised model, the most widely recognized type of machine learning over all orders, is a model that is prepared on a rich arrangement of legitimately “labeled” exchanges. Every exchange is labeled as either extortion or non-misrepresentation. The models are prepared by ingesting enormous measures of labeled exchange subtleties so as to learn designs that best reflect genuine practices. When building up a supervised model, the measure of spotless, significant preparing information is specifically connected with model exactness.

- Unsupervised models are intended to spot atypical conduct in situations where labeled exchange information is generally thin or non-existent. In these cases, a type of self-learning must be utilized to surface examples in the information that are imperceptible to different types of examination. Unsupervised models are intended to find exceptions that speak to beforehand concealed types of fraud. These AI-based strategies recognize conduct abnormalities by distinguishing exchanges that don’t comply with the dominant part. For exactness, these inconsistencies are assessed at the individual dimension and in addition through modern friend aggregate examination.

By picking an ideal mix of managed and unsupervised AI methods you can distinguish already concealed types of suspicious conduct while rapidly perceiving the more unobtrusive examples of frauds that have been recently seen crosswise over billions of records.

Supervised AI models and Fraud Detection

Machine learning is a subfield of AI that endeavors to address the issue of past methodologies being excessively unbending. Scientists needed the machines to gain from information, as opposed to encoding what these PC projects should search for (an alternate methodology from master frameworks). Machine learning started to make enormous walks during the 1990s, and by the 2000s it was adequately being utilized in battling misrepresentation too.

Connected to fraud, supervised machine learning (SML) speaks to a major advance forward. It’s tremendously not the same as standards and notoriety records on the grounds that as opposed to taking a gander at only a couple of highlights with straightforward principles and doors set up, all highlights are viewed as together.

All things considered, SML connected to fraud detection is a functioning territory of improvement in light of the fact that there are numerous SML models and methodologies. For example, applying neural systems to misrepresentation can be exceptionally useful in light of the fact that it computerizes include designing, a generally exorbitant advance that requires human mediation. This methodology can diminish the rate of false positives and false negatives contrasted with other SML models, for example, SVM and arbitrary woods models, since the shrouded neurons can encode a lot more element conceivable outcomes than should be possible by a human.

Unsupervised AI Models and Fraud Detection

Contrasted with SML, unsupervised machine learning (UML) has split less area issues. For fraud detection, UML hastn’t generally possessed the capacity to encourage much. Regular UML approaches (e.g., k-implies and various leveled bunching, unsupervised neural systems, and foremost segment investigation) have not possessed the capacity to accomplish great outcomes for misrepresentation discovery. Having an unsupervised way to deal with extortion can be hard to work in-house since it requires preparing billions of occasions all together and there are no out-of-the-crate powerful unsupervised models. Nonetheless, there are organizations that have made progress around there.

The reason it very well may be connected to extortion is because of the life structures of most misrepresentation assaults. Ordinary client conduct is disorganized, yet fraudsters will work in examples, regardless of whether they understand it or not. They are working rapidly and at scale. A fraudster wouldn’t attempt to take $100,000 in one go from an online administration. Or maybe, they make handfuls to a large number of records, every one of which may return a benefit of a couple of pennies to a few dollars. Be that as it may, those exercises will definitely make examples, and UML can identify them.